How to Price Your Bookkeeping Services for Profit and Growth

Most bookkeepers and accountants undercharge for their services. That’s not an opinion—it’s a fact backed by benchmarking studies. The problem isn’t just about charging too little; it’s about pricing the right way and communicating value effectively.

Mark Wickersham, a profit improvement expert, has spent decades teaching bookkeepers how to price their services strategically. In a conversation on The Successful Bookkeeper podcast, he broke down the key challenges with pricing and how bookkeepers can move from hourly billing to value-based pricing. Here’s what you need to know.

Why Hourly Billing is a Mistake

One of the biggest pricing mistakes bookkeepers make is charging by the hour. It seems logical—more time spent means higher fees—but it actually limits profitability in several ways:

- Clients focus on the clock, not the outcome. When you charge by the hour, clients compare your rate to other professionals or even their own employees. Instead of seeing the value of your expertise, they see a number they want to reduce.

- You get penalised for efficiency. The better and faster you get at bookkeeping, the less you earn. That doesn’t make sense. Clients should pay for your expertise and the results you deliver, not just the time you spend.

- It creates pricing uncertainty. Clients prefer knowing what they’ll pay upfront. Hourly rates make it hard to predict costs, leading to sticker shock when invoices arrive.

Understanding Value Pricing

Value pricing is the practice of setting fees based on the value you provide, rather than the time you spend. The challenge? Value is subjective. What’s worth £500 a month to one client might only be worth £200 to another. That’s why pricing needs to be flexible.

Wickersham explains that successful value pricing requires three key elements:

- Recognising that different clients value services differently. The same bookkeeping work can be worth more to a growing business than to a small freelancer.

- Using price discrimination strategies. This means structuring pricing in a way that allows different clients to pay different amounts based on their needs.

- Giving clients options. People like to feel in control. Offering tiered packages lets clients choose a price point that fits their expectations and budget.

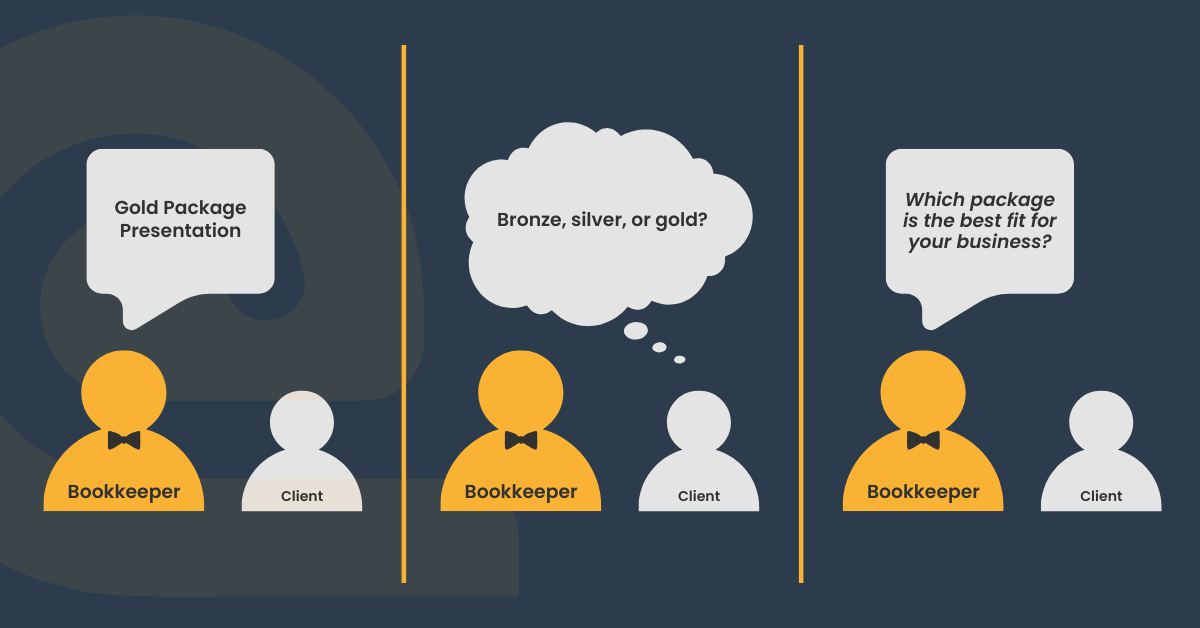

The Power of Three: Menu Pricing for Bookkeepers

One of the most effective ways to implement value pricing is through menu pricing—also known as “the magic of three.” Instead of quoting a single price, offer three options:

- Basic (Bronze): Covers essential bookkeeping services.

- Standard (Silver): Includes additional services, such as reporting or payroll.

- Premium (Gold): Provides high-level support, advisory services, or priority access.

Why three? Because most people instinctively choose the middle option. It feels like a balanced choice—not too expensive, not too basic. This simple pricing strategy can increase average fees significantly.

Options and Upsells: Pricing Beyond Packages

While menu pricing is a great starting point, adding customisable options can increase revenue even further. Instead of bundling everything into set packages, give clients the ability to select additional services based on their needs.

For example, before revealing a final price, ask:

- Would you like us to provide a monthly financial report?

- Do you need payroll processing for your team?

- Would you prefer priority access to your bookkeeper?

Each “yes” increases the price automatically. Clients feel like they are in control of their costs, and you capture more value without feeling pushy.

How to Reveal Pricing Strategically

One of the most common pricing mistakes is revealing a number too soon. Wickersham suggests a better approach:

- Communicate value first. Walk clients through what you offer and how it benefits their business.

- Let them choose their preferred package or services. Ask, “Which of these options do you think is the best fit for your business?”

- Present the price after they’ve committed to an option. This shifts their focus from price to value.

If the price is too high, you can adjust by removing features—never by lowering your base rate. This ensures clients make value-based decisions instead of focusing solely on cost.

The Psychology of Pricing: Why Anchoring Matters

Pricing isn’t just about numbers—it’s about perception. When a client hears a price for the first time, it sets an anchor in their mind. Everything they see afterward is judged relative to that anchor.

For example, if you present your highest-priced package first, the other options seem more affordable. If you start too low, everything else feels expensive. That’s why the first price you reveal should always be at the top end of what a client might pay.

This technique helps you avoid leaving money on the table. If a client is willing to pay more for a premium service, they should have the opportunity to do so.

Overcoming the Fear of Raising Prices

Many bookkeepers hesitate to increase their rates because they worry about losing clients. But the reality is, most clients won’t leave over a reasonable price adjustment—especially if they see the value.

Here are a few ways to gain confidence in pricing:

- Start small. If you’re nervous about price increases, begin with new clients before adjusting existing ones.

- Use a system. Structured pricing strategies make it easier to justify fees and remove the guesswork.

- Test different approaches. Experiment with different pricing models and track what works best.

- Remember that quality clients value expertise. The clients who argue over every pound aren’t the ones you want to build a business around.

Why Confidence Matters in Pricing

Pricing isn’t just about numbers—it’s about confidence. Clients pick up on uncertainty, so if you hesitate when quoting a price, they’ll negotiate harder or look elsewhere.

Here’s how to build confidence:

- Practice pricing conversations before meeting with clients.

- Use a structured pricing tool to ensure consistency.

- Remember that low prices don’t create loyalty—great service does.

Many bookkeepers who follow these principles see an immediate revenue increase. Some even double their income in less than a year—without adding more clients.

Take Control of Your Pricing

Your pricing should reflect the value you provide, not just cover your costs. If you’re undercharging, now is the time to make a change.

Try effective pricing today

and start building a more profitable bookkeeping business.