How to Price Your Accounting Services for Maximum Value (Without Hourly Billing)

Pricing services correctly is a fundamental challenge many accountants face. Get it wrong, and you're either undervaluing your expertise or risking client dissatisfaction. Traditional hourly billing, often considered standard practice, frequently leads to confusion and frustration among clients, primarily due to unexpected or unclear costs.

Mark Wickersham, a chartered accountant and renowned pricing expert, advocates strongly for value pricing, which is an approach focused on the value clients perceive in your services rather than just costs.

What is Value Pricing?

Value pricing involves setting your prices based on the value you deliver to clients, rather than simply calculating costs and adding a margin. Hourly billing inherently ignores customer expectations and often leads to "surprise bills." Value pricing, instead, begins with understanding client needs and expectations.

Unlike traditional pricing methods that focus on costs and time spent, value pricing considers the outcome and the benefits your service provides. When clients see clear value in your offering, they are more willing to pay a price that reflects that value.

Why Hourly Billing Falls Short

Hourly billing has been the standard approach in many accounting firms, but it creates several issues:

- Lack of transparency: Clients dislike receiving invoices with unexpected charges.

- Encourages inefficiency: Firms are rewarded for spending more time rather than delivering results faster.

- Limits profitability: The only way to earn more is to work more hours, creating a ceiling on potential income.

Value pricing eliminates these issues by ensuring fees align with the tangible benefits clients receive. Instead of measuring time, accountants can focus on delivering results and improving service quality.

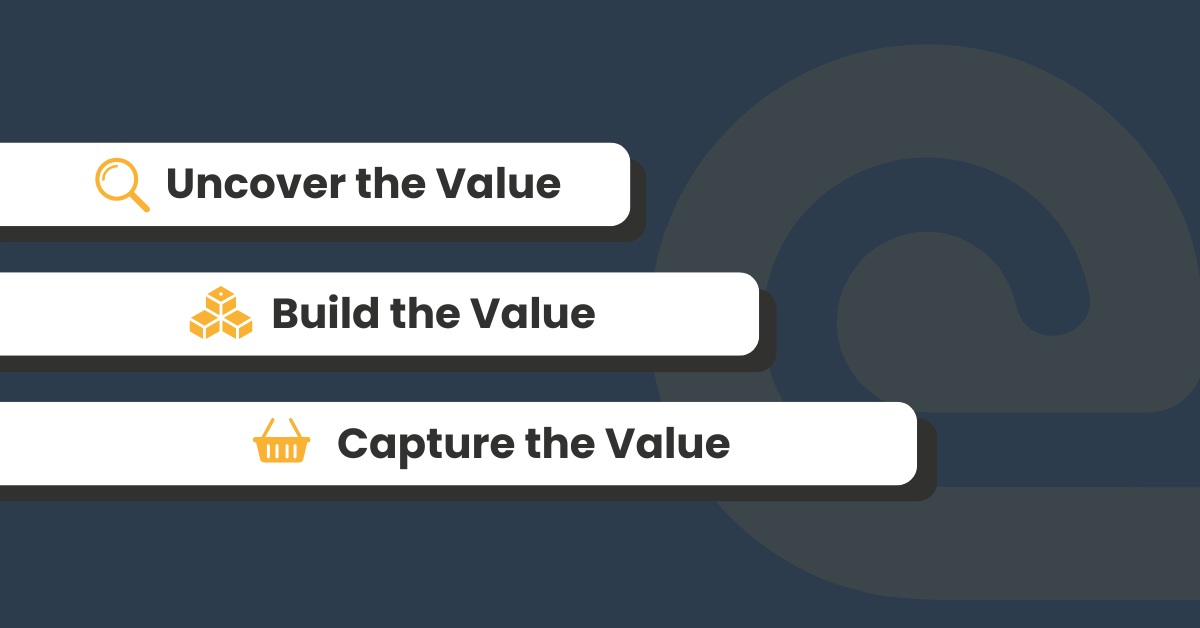

The Three Stages of Value Pricing

1. Uncover the Value

Understanding what clients truly need is the first step in implementing value pricing. This involves in-depth conversations to identify their pain points, goals, and expectations. Some key questions to ask include:

- What are your biggest challenges with your current accounting setup?

- What financial insights would help you make better business decisions?

- How important is real-time access to financial data?

- What level of reporting and analysis do you need?

By asking these questions, you gain insight into what clients value most, allowing you to tailor your pricing accordingly.

2. Build the Value

Once you understand a client’s needs, the next step is to communicate how your services solve their problems. This step is crucial because clients need to see the direct connection between your expertise and the benefits they’ll receive.

Consider presenting value pricing in a structured way by offering different service levels. The "menu pricing" approach, where clients choose from Bronze, Silver, and Gold packages, allows them to select a solution that fits their needs and budget.

When building value:

- Clearly define what each package includes.

- Highlight the benefits of each option, not just the features.

- Provide case studies or examples of past success.

3. Capture the Value

The final step is setting a price that reflects the true value of your services. Rather than basing your fee on costs, it should be determined by the results your clients achieve.

When presenting your price, always do so in person or via a live meeting. Sending a proposal without discussion risks clients focusing only on the numbers rather than understanding the value behind them. A face-to-face conversation allows you to:

- Explain the reasoning behind your pricing.

- Address any concerns immediately.

- Adjust service options based on client feedback.

Using Psychology to Strengthen Value Pricing

Clients often struggle to assess pricing objectively, which is why psychology plays a key role in the decision-making process. The way you structure and present your prices significantly influences how clients perceive value.

1. The Power of Choice

Giving clients multiple pricing options, such as Bronze, Silver, and Gold tiers, helps them feel in control. When people see multiple choices, they are more likely to pick one rather than reject all options.

2. Anchoring Pricing Perceptions

Anchoring is a pricing strategy where you present a higher price first, making subsequent options appear more reasonable. For example, if you introduce a premium service at £2,000 before mentioning a mid-tier option at £1,200, the lower price feels more affordable in comparison.

3. Framing the Price Based on Benefits

Rather than just stating a monthly fee, connect the price to its impact. Instead of saying, “This service costs £500 per month,” frame it as, “For just £500 a month, you gain real-time financial insights, proactive tax planning, and personalised business growth strategies.” This approach reinforces the value behind the price.

Systematising Value Pricing with Effective Pricing

Successfully implementing value pricing requires a structured approach. Many firms struggle because they rely on manual methods, making it difficult to consistently apply the model.

This is where pricing software, such as Effective Pricing, becomes essential. The Value Pricing Academy’s Effective Pricing software helps accountants:

- Automate pricing discussions with structured client interactions.

- Provide real-time adjustments based on client preferences.

- Create transparency by involving clients in the pricing process.

By integrating a pricing system, firms can ensure consistent, fair, and profitable pricing that aligns with their client’s needs.

The Business Impact of Value Pricing

Firms that transition to value pricing experience several key benefits:

- Higher profitability: Clients are willing to pay more when they understand the value they receive.

- Stronger client relationships: Transparent pricing fosters trust and reduces misunderstandings.

- Scalability: Value pricing allows firms to increase revenue without simply working more hours.

Many accountants who have implemented value pricing have seen their fees increase by two to three times without losing clients. This is because clients appreciate knowing exactly what they’re paying for and the results they can expect.

Making the Switch to Value Pricing

Shifting from hourly billing to value pricing requires a mindset change, but the rewards are well worth the effort. To successfully transition:

- Start small – Implement value pricing for a few key services before applying it firm-wide.

- Communicate effectively – Clearly explain the benefits of value pricing to clients.

- Use the right tools – Leverage software like Effective Pricing to streamline the process.

Try Effective Pricing

Ready to take the guesswork out of pricing? Try Effective Pricing and confidently set prices that reflect the true value of your services.

By adopting value pricing, you ensure that your fees reflect the expertise and impact you bring to your clients. This approach not only enhances profitability but also strengthens client trust—creating a win-win for both accountants and their clients.